Parniangtong (2016) defined strategic sourcing as “the process of developing channels of supply at the lowest total cost, not just the lowest purchase price” and suggested to:

- Focus on the total delivered value, not the purchase price;

- Choose a collaborative approach to dealing with suppliers, rather than oversight; and

- Focus on enhancing profitability, rather than cost savings.

Therefore, in the strategic sourcing mind frame, purchasing decisions are no longer siloed nor limited to the purchasing department, but require additional collaboration from other departments and monitoring throughout the supply chain. In particular, one of the most significant related values that comes to mind is the Cost of Quality (CoQ), which traditional purchasing strategies didn’t necessarily consider, as they mainly focused on picking the supplier who offered the lowest price.

Mathematically speaking, the CoQ is calculated as follows:

CoQ = CoGQ + CoPQ

Where CoGQ stands for Cost of Good Quality and CoPQ for Cost of Poor Quality.

The Cost of Good Quality (CoGQ) may be interpreted as the amount of money invested/spent by the company in making sure defects are prevented or detected as early as possible throughout the supply chain. For illustrative purposes, we could consider these green light defects.

According to Quality-One International (n.d.), some examples of prevention costs may be:

- Establishing Product Specifications,

- Quality Planning,

- New Product Development and Testing,

- Development of a Quality Management System (QMS), and

- Proper Employee Training.

Meanwhile, appraisal costs are those that arise from inspections, tests, and audits, and are meant to maintain acceptable product quality levels. According to Quality-One International (n.d.), some examples are:

- Incoming Material Inspections,

- Process Controls,

- Check Fixtures,

- Quality Audits, and

- Supplier Assessments (Quality-One International, n.d.).

On the other end, the Cost of Poor Quality (CoPQ) may be regarded as the money spent by companies to fix defects, that were hopefully detected internally or maybe tragically by the customer. Therefore, we could consider these yellow and red light defects, respectively.

Some internally detected defects (yellow light) might be:

- Excessive Scrap,

- Product Re-work,

- Waste due to poorly designed processes,

- Machine breakdown due to improper maintenance, and

- Costs associated with failure analysis (Quality-One International, n.d.).

Likewise, some defects detected externally (i.e. by the customer; red light) might include:

- Service and Repair Costs,

- Warranty Claims,

- Customer Complaints,

- Product or Material Returns,

- Incorrect Sales Orders,

- Incomplete BOMs, and

- Shipping Damage due to Inadequate Packaging (Quality-One International, n.d.).

It’s extremely important to be aware that the closer the defect is to the customer, the more expensive it will be for the company to fix it. Bear in mind that in the case of products, reverse logistics costs are pretty significant (McKevitt, 2016).

A relatively recent example is Chipotle Mexican Grill’s foodborne illness outbreak in which a bacterium that forms when food is left out at unsafe temperatures struck nearly 700 people with gastrointestinal problems (LaVito & Rogers, 2018). In this case and in addition to the lawsuits, even the brand’s reputation suffered, evidently.

Another, yet older, case is that of Mattel. In 2007, the toy behemoth recalled 18 million toys because they had toxic lead paint. This case is highly relevant as this whole situation could’ve been avoided if Mattel had established and applied the appropriate quality controls throughout its supply chain, and in particular when receiving the products from Chinese contract manufacturers, since the toys had been painted by them.

In both cases, the companies were able to recover, more or less, but at a great expense.

Another aspect to consider when sourcing strategically is the overhead that will result from choosing a supplier over another. Will the client have to perform more quality control processes? Will it be necessary to hire professionals who speak other languages in order to communicate with the supplier? How compatible are the ICT systems? Etc.

In a commoditized market, a highly relevant question is: Where does the price difference come from? Based on my experience and that of several anonymous interviewees, it’s usually related to quality. More or less controls? Better or worse raw materials? More or less advanced technologies? Quicker or slower response times? Local or sub-outsourced offshore personnel? Etc.

It’s extremely important to have an understanding of where such a price reduction comes from, in order to evaluate the risks and estimate the respective impact it could have on the client’s supply chain and competitive advantage.

For example, in street and roadway construction projects one may sometimes see workers without the appropriate protection gear (eyes, ears, hands, …). There’s the rebate. What if an inspector shows up or a worker gets hurt and files a lawsuit?

In the airline industry, most low-cost companies removed the services included with the minimum purchasable product (i.e. ticket) and offer them as supplements. They therefore unbundled the traditional offering, with several adaptations for low-cost travelers, resulting in a reduced customer experience. However, these planes won’t fall because tickets “cost” less: the quality controls for the vehicles are hopefully still in place.

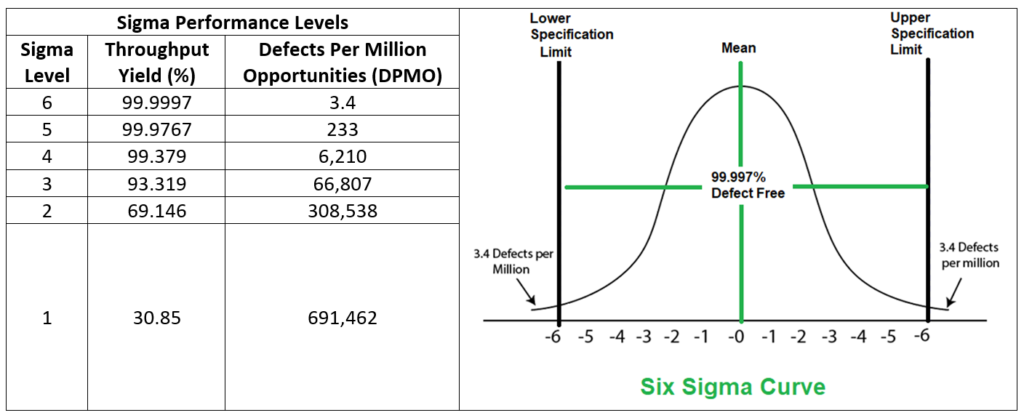

Experience has taught me that usually the sigma level is proportional to the price paid for a product or service. The sigma level indicates the throughput yield (error-free rate) and conversely the Defects Per Million Opportunities (DPMO). Therefore and in other words, the lower the price, the lower the quality. So, before signing a service or production contract, the purchasing cross-functional team should evaluate how to compensate for the remaining sigmas or quality gap, if deemed necessary.

Source: prepared by the author

A meaningful bonus will usually motivate suppliers to go the extra mile. This is self-evident and some well-known examples are waiter tips and CEO compensation plans.

An interesting question that buyers might ask vendors during the selection process could be: What impact have Six Sigma and Lean had over your organization? The answers will generally reveal a lot about a company.

When evaluating providers and having reached a reduced list of candidates, buyers might also want to have a look at their public corporate documents, such as financial reports, presentations, and annual shareholder meeting transcripts. For example, these will usually indicate how much money companies invest in R&D, training, etc. which will certainly come in handy when analyzing how innovative a supplier might be and how the competitive advantage gained by its new technologies might flow down the supply chain. This information could also help determine the most convenient contract duration and stipulate clauses to make the most of it.

Although it may seem reasonable to push the CoQ down the supply chain to the final consumer, if competitors offer products or services with similar features and quality levels, but at a lower price, final consumers will probably go for them. Such a result will have a negative impact on the company’s profit and the market price per share will quite surely decrease. Shareholders won’t be very happy.

In conclusion, it’s important to be aware of the impact that strategic sourcing and the Cost of Quality could have on a company and throughout its supply chain.

Remember:

- Usually the first thing sacrificed is quality: less features, less quality controls, or worse costumer experience.

- Ask yourself how will choosing a supplier over another impact your company’s competitive advantage?

- Don’t be surprised if you get what you pay for!

For more information on this subject, don’t hesitate to check out my book Outsourcing: Avoiding Unnecessary Adversities, now available on Amazon!

References

LaVito, A., & Rogers, K. (2018, August 16). Chipotle confirms cause of foodborne illness at Ohio restaurant. Retrieved from CNBC: https://www.cnbc.com/2018/08/16/chipotle-confirms-cause-of-foodborne-illness-at-ohio-restaurant.html

McKevitt, J. (2016, December 20). Reverse logistics dilemmas cost companies up to $260B. Retrieved from Supply Chain Dive: https://www.supplychaindive.com/news/reverse-logistics-returns-supply-management/432665/

Parniangtong, S. (2016). Strategic Sourcing: Concepts, Principles and Methodology. Springer.

Quality-One International. (n.d.). Cost of Quality (COQ). Retrieved 03 28, 2020, from Quality-One International: https://quality-one.com/coq/

Reece, J., & Norman, L. (2006, December 1). The Six Hidden Costs of Reverse Logistics. Retrieved from https://www.inboundlogistics.com/cms/article/the-six-hidden-costs-of-reverse-logistics/