Alibaba

Alibaba Group Holding Limited was founded on June 28, 1999 in the Cayman Islands as an exempted company with limited liability. It is listed in both the NYSE as “BABA” and the Hong Kong Stock Exchange as “9988.” Alibaba’s mission is to make it easy to do business anywhere and they intend to help small enterprises become more competitive, locally and globally, via the Internet, by providing the technology infrastructure and marketing reach to help merchants, brands, retailers and other businesses to leverage the power of new technology to engage with their users and customers and operate in a more efficient way (Alibaba Group Holding Limited, 2021, pp. 60-62). In a few words, they offer commerce, cloud computing, and entertainment services.

With solutions such as Taobao Marketplace, Tmall, Freshippo, and Taoxianda, Alibaba has become the largest retail commerce business in the world in terms of gross merchandise value (GMV) (Alibaba Group Holding Limited, 2021, p. 63), which is a measure of the growth of the business or use of the site to sell merchandise owned by others (Hayes, 2021). Alibaba.com is China’s largest integrated international online marketplace by revenue, serving roughly 190 countries. Likewise, 1688.com is China’s leading wholesale marketplace by revenue. In Southeast Asia, Lazada is a prominent e-commerce solution. On the other hand, AliExpress is one of the top international retail marketplaces, connecting Chinese manufacturers and distributors with clients all around the world. Alibaba also offers logistics services, via Cainiao Network and Fengniao Logistics, and travel services with Fliggy. Another notorious business of Alibaba is Alibaba Cloud, the world’s third largest Infrastructure as a Service (IaaS) provider. Other important Alibaba businesses include Lingshoutong, Kaola, Trendyol, Daraz, Youku, Alibaba Pictures, Amap, and DingTalk (Alibaba Group Holding Limited, 2021, pp. 63-65).

Meanwhile, Ant Group handles the financial and payment services for Alibaba’s platforms.

Corporate Structure

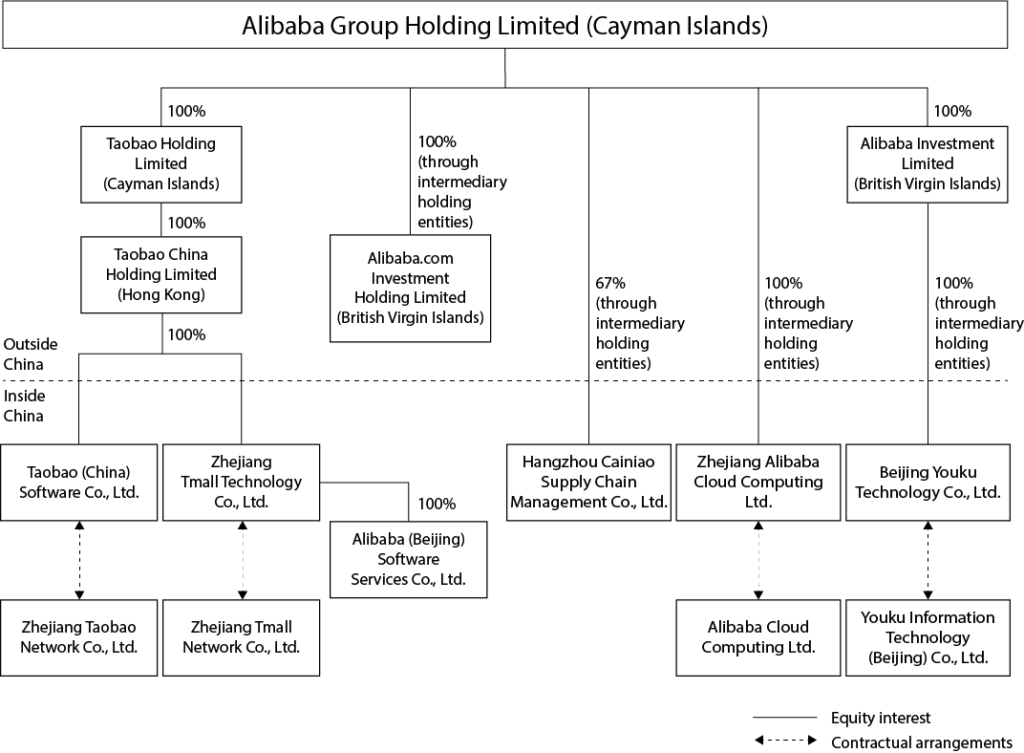

With regard to Alibaba’s corporate structure, it may be divided into two main groups of companies: those in China and those outside, as shown in the graph below. In particular, the outside companies are mainly holding companies located in tax havens, while those in China are the ones that actually offer services to the clientele.

Source: Alibaba Group Holding Limited (2021, p. 110)

At this time, the Cayman Islands don’t levy any taxes on individuals or corporations, based on profits, income, gains, or appreciation, and dividends aren’t subject to taxation.

As of the People’s Republic of China (PRC), although the Alibaba group earns a substantial income from the dividends paid by its subsidiaries in this country, it’s not a Chinese resident enterprise because none of the following conditions is met:

- The primary location of the day-to-day operational management is in the PRC;

- Decisions relating to the enterprise’s financial and human resource matters are made or are subject to approval by organizations or personnel in the PRC;

- The enterprise’s primary assets, accounting books and records, company seals, and board and shareholders meeting minutes are located or maintained in the PRC; and

- 50% or more of voting board members or senior executives habitually reside in the PRC (Alibaba Group Holding Limited, 2021, pp. 192-193).

Concerning the subsidiaries located in Hong Kong, they have been subject to a profits tax of 16.5%.

Variable Interest Entities

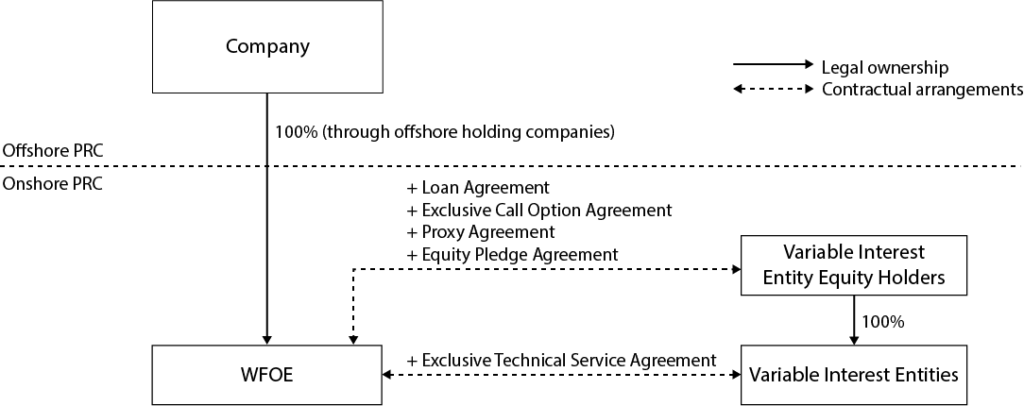

Since in China there are legal restrictions on foreign ownership and investment in strategically sensitive industries, such as value-added telecommunications services, Alibaba, as do other foreign-incorporated holding company structures that operate in these industries in China, drives several of its businesses, in which foreign investment is restricted, by means of contractual agreements with variable interest entities (VIE). These entities are incorporated and 100% owned by Chinese citizens or by Chinese entities owned and/or controlled by Chinese citizens. Alibaba’s VIEs hold Internet content provider (ICP) licenses and other regulated licenses and operate its Internet businesses and other businesses in which foreign investment is restricted or prohibited.

Meanwhile, Alibaba’s wholly-foreign-owned enterprises (WFOE) provide technologies and other services to our customers, in addition to holding material assets, conducting material operations and generating the significant majority of revenues. Specifically, WFOEs directly capture the cash flows from operations, without relying on contractual agreements to transfer cash flow from the VIEs to the WFOEs.

Source: Alibaba Group Holding Limited (2021, p. 112)

WFOEs grant loans to the relevant VIE equity holders, which may only be used for the purpose of its business operation activities as agreed with the WFOE. The WFOE, in turn, may request the acceleration of repayment at its discretion. When the VIE holders repay the outstanding amount early, the WFOE or a third party designated by it may purchase the equity securities in the VIE at a price equal to the outstanding amount of the loan.

A WFOE also has an exclusive call option on the VIE’s assets and equity interest and a right to cash in dividends and other distributions. Moreover, any person designated by the WFOE may exercise rights as an equity holder by means of a proxy agreement with the VIE and its current equity holders. The equity pledge agreement, however, prohibits any equity or asset transfers by the VIE. Finally, each WFOE enters into an exclusive technical services agreement with a specific WFOE that transfers the profits from the VIE to the WFOE.

In other words, WFOEs control VIEs and receive their profits.

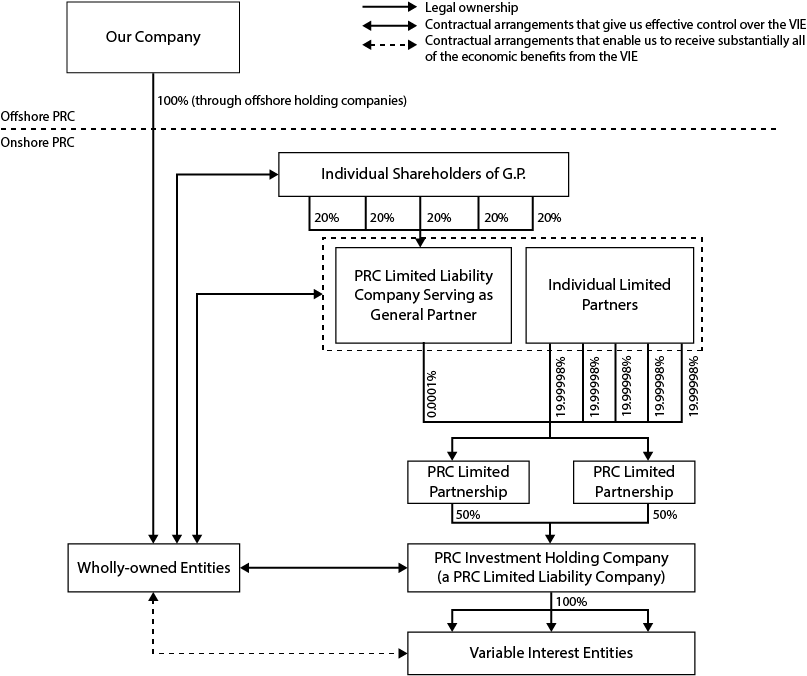

Subsequently, Alibaba designed an enhanced VIE structure to:

- Reduce the key man and succession risks associated with natural person VIE equity holders, through a new structure that has widely dispersed interests among natural person interest holders;

- Create a VIE ownership structure that is more stable and self-sustaining, by distancing the natural person interest holders with the VIE with multiple layers of legal entities, including a partnership structure; and

- Further enhance Alibaba’s control over the VIEs through multiple layers of contractual arrangements (Alibaba Group Holding Limited, 2021, p. 112).

An enhanced VIE is typically owned by a PRC limited liability company, rather than individuals. This company is, in turn, directly or indirectly owned by two PRC limited partnerships, each of which holds 50% of the equity. Each of these partnerships is formed by a PRC limited liability company, which acts as a general partner and is formed by several members of the Alibaba Partnership and Alibaba’s management (who are PRC citizens), and the same group of natural people, who act as limited partners.

Source: Alibaba Group Holding Limited (2021, p. 113)

Risks

Although VIEs might seem to be a feasible solution to China’s restrictions on foreign investment, they lie on grey area and investors should be aware of the risks involved. In fact, Alibaba states that:

- If the PRC government deems that the contractual arrangements in relation to our variable interest entities do not comply with PRC regulations on foreign investment, or if these regulations or the interpretation of existing regulations changes in the future, we could be subject to penalties, or be forced to relinquish our interests in those operations, which would materially and adversely affect our business, financial results, trading prices of our ADSs, Shares and/or other securities; and

- Substantial uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and its implementing rules and other regulations and how they may impact the viability of our current corporate structure, business, financial condition and results of operations (Alibaba Group Holding Limited, 2021, p. 3).

These, however, aren’t the only risks related to investing in Alibaba. Besides the underlying legal quicksand of its financial instruments, investor right enforcement might be hindered by the location of its directors and officers:

Most of our directors and substantially all of our executive officers reside outside the United States and Hong Kong S.A.R. and a substantial portion of their assets are located outside of the United States and Hong Kong S.A.R. As a result, it may be difficult or impossible for our shareholders (including holders of our ADSs and Shares) to bring an action against us or against these individuals in the Cayman Islands or in China in the event that they believe that their rights have been infringed under the securities laws of the United States, Hong Kong S.A.R. or otherwise. Even if shareholders are successful in bringing an action of this kind, the laws of the Cayman Islands and China may render them unable to enforce a judgment against our assets or the assets of our directors and officers. There is no statutory recognition in the Cayman Islands of judgments obtained in the United States, Hong Kong S.A.R. or China, although the courts of the Cayman Islands will generally recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits (Alibaba Group Holding Limited, 2021, p. 56).

Control channels

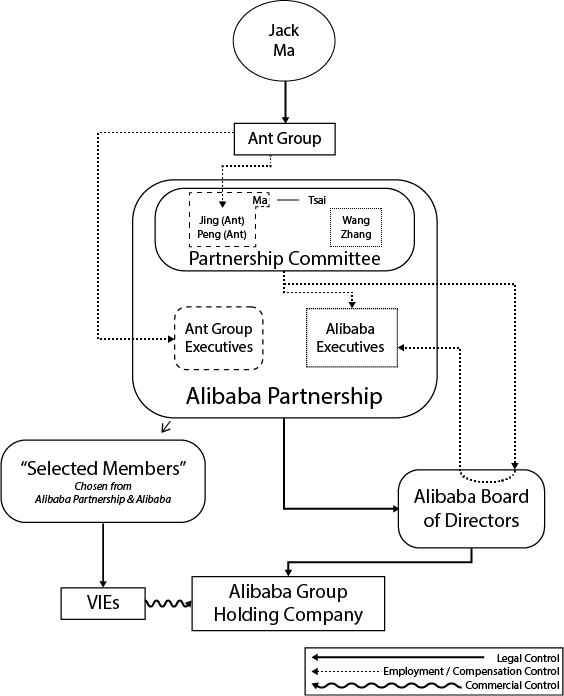

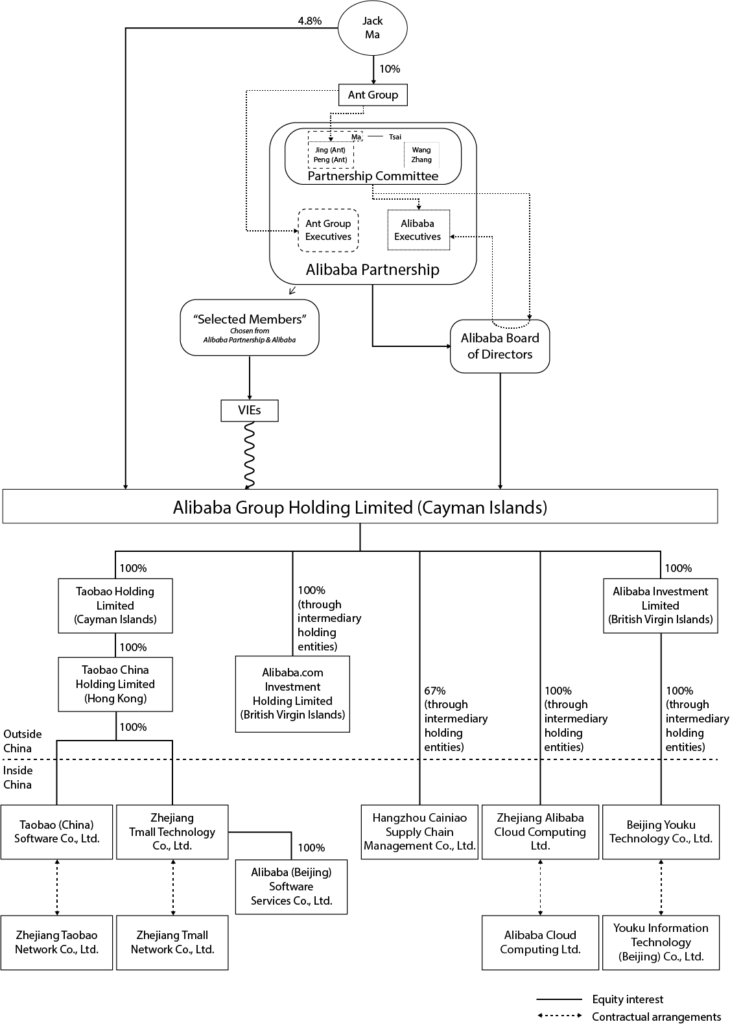

Rather than establishing a corporate structure with numerous layers of holding companies, each with several classes of shares that convey multiple votes to a limited group of shareholders, thereby reducing the capital needed by such group to control the structure, Jack Ma has found an ingenious way to control the Alibaba Group Holding Company with only 4.8% of its shares (Fried & Kamar, 2021, p. 7). Said structure has been illustrated as follows:

Source: Fried & Kamar (2021, p. 21)

Even though Jack Ma only owns 10% of Ant Group’s shares, he exerts control over the company through related entities (CNBC, 2021). Such supremacy in effect allows him to replace all of Ant’s eight executives and modify their salaries, titles, and responsibilities. Subsequently, the partners of the Alibaba Partnership (i.e. Lakeside Partners L.P.) that are designated by Ant could actually be a result of Ma’s influence over the latter. As of the remaining partners (of the Alibaba Partnership), these may be manipulated by Ma through his control of the Partnership Committee, which establishes their salaries and affects their employment situation at Alibaba. More specifically, Ma controls said committee as a continuity (almost lifelong) partner by being able to nominate candidates for the next committee, and eventually lead to their election, according to the extent of his control over the current committee.

Needless to say, the Alibaba Partnership has significant power over Alibaba. In fact, it can appoint the majority of Alibaba’s directors, after being nominated by the Partnership Committee and obtaining a majority vote of the partners. Although, if a nominee isn’t elected, the Partnership may appoint someone else as an interim director.

VIEs may also be used by Jack Ma as domination mechanism over the Alibaba Group, since, as was mentioned previously, the lie on legal grey area and this situation may be exploited to influence the company’s leadership.

To conclude, Jack Ma’s control structure over the Alibaba Group has been integrated and illustrated as follows:

Source: prepared by the author

References

Alibaba Group Holding Limited. (2021, July 27). UNITED STATES SECURITIES AND EXCHANGE COMMISSION – FORM 20-F. Retrieved from Alibaba Group: https://www.alibabagroup.com/en/ir/pdf/form20F_210727.pdf

CNBC. (2021, April 18). Ant Group is reportedly exploring options for founder Jack Ma to divest his stake, give up control. Retrieved from CNBC: https://www.cnbc.com/2021/04/19/ant-group-reportedly-exploring-options-for-jack-ma-to-divest-his-stake.html

Fried, J. M., & Kamar, E. (2021, February 22). Alibaba: A Case Study of Synthetic Control. Retrieved from SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3644019

Hayes, A. (2021, July 25). Gross Merchandise Value (GMV). Retrieved from Investopedia: https://www.investopedia.com/terms/g/gross-merchandise-value.asp